I am going to play armchair economist here for a second, but does anyone else see the irony in the fact that lower and middle class America has brought the economy to its knees from trying to be like the upper class? After growing up in the shadow of 80s excess, internet millionaires and the notion of "entitlement" from being hard working Americans, I find it interesting that all of the "no document" loans made have essentially crippled the world economy and no really knows where the bottom is. I am no economist, but I now have survived the dot-com boom, 9/11 and worked for both Freddie Mac and Countrywide, so I have an idea of what is going on. I have also traded and day traded for years, so I have an idea of what fuels the economy and here is where I see this going:

- The Dow will hit 8000 before 2010. Cash will be king and the market will make an overdue "major correction". It is the natural economic cycle.

- Credit will dry up for the next 2 years and without credit to fuel ideas, growth will be minimal. Imagine a GDP of less than 2% for awhile and you get my drift

- As the baby boomers come into retirement the next few years, the rules will change and the concept of "safe retirement" will be a misnomer. As they have done previously, this segment will shape the economic growth of the future simply because they will have the capital.

- I predict unemployment will hit 10% in the USA as college grads and poor retirees may compete for some of the same low paying jobs. There will be resentment toward immigrants doing jobs that suddenly don't look so bad. Remember, a paycheck is all relative when there is no money in the bank.

- Our entire economy will be reshaped from this and no one knows how "safe" the end picture will be. 1 Trillion dollars is a drop in the bucket for America. The real fear will be that the confidence in America has erroded too far. Imagine if suddenly the world said "You are too much of a risk. Your reign has ended."This is the path we are going down. We could become the Wal-mart discount seller to the world because suddenly foreign cash could snatch us up during a "blue light special" my friends.

These are purely my thoughts but as a someone who understand concepts like the world economy, how shorting stocks is critical for balancing the market, how the human psychology of HELOCs works, and how keeping up with the Joneses under the guise of "endless growth" has led us down the wrong path, I have to say that future (ie the next four years) is not looking too bright.

I hope I am wrong, but ironically we got into this mess from sending the following message to all levels of American: Pimp your life, live beyond your means, don't save for the future and live in the now. Your 401K, home and income will rise no matter what. Guess what America..you may have been wrong and as they say, "payback is a bitch." I am not a religious person, but I say this - God Bless America....and please hurry-! We are in for a bumpy ride.

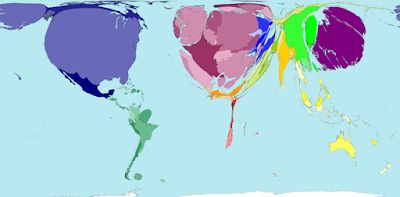

This wealth map shows which territories have the greatest wealth when Gross Domestic Product (GDP) is compared using currency exchange rates. This indicates international purchasing power - what someone’s money would be worth if they wanted to spend it in another territory. For some their money will gain value when they move - others’ money will lose value. This facilitates the movement of some people, whilst severely limiting that of others.

Independence Days

14 years ago

0 comments:

Post a Comment